Charter FIRST is the Financial Integrity Rating System of Texas (FIRST), which is detailed in Texas Education Code 39.082. The purpose and goal of having a financial accountability rating system is to ensure that open enrollment charter schools continually strive to improve the management of their financial resources and provide transparency and openly report results to … Read More

Preparing for your Year-End Audit

By now your charter school has likely begun its year-end audit process of pulling back up documentation for several areas of your business services. While no one is excited for year-end audits, there are lots of ways to lessen the burden and ensure that the audit runs smoothly. At Charter School Success, we help our … Read More

How Does My Charter’s Fiscal Risk Rating Affect Us?

Federal regulations require TEA to annually evaluate each grant recipient’s risk of noncompliance with the federal statutes, rules, terms, and conditions of their award.

Contribution to TRS: New Minimum Salary Schedule increase

Although charter schools are not subject to paying their teachers based on the minimum salary schedule, HB3 requires that open enrollment charter schools pay the state’s contribution on the portion of a member’s TRS eligible salary that exceeds the statutory minimum or the “state minimum.” Members include classroom teachers, full-time librarians, full-time counselors certified under … Read More

Federal Financial Drawdown

Federal Risk Level The Federal Fiscal Monitoring Division conducts an annual risk assessment of all charters, to determine their potential risk of noncompliance. Based upon the outcome of the risk assessment, charters are assigned a risk level of low, medium, or high. The division updates the risk assessment model annually to ensure that risk indicators … Read More

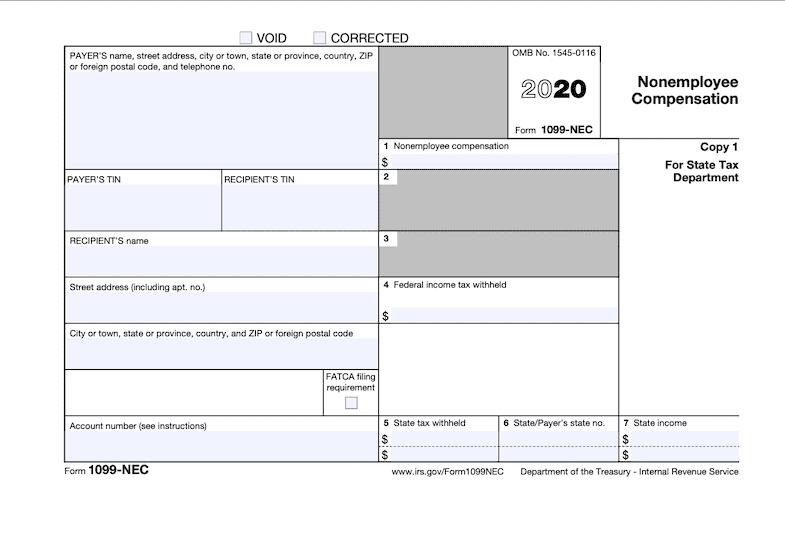

New 1099 Form to be used for 2020

Don’t let the new form make you uneasy. It’s filed just the same way that the old 1099-Misc non-employee compensation forms were filed. Your old box 7 vendors are now just getting their own special form, the 1099-NEC. What’s new? Effective for the 2020 tax year, form 1099-NEC has been implemented by the IRS. The … Read More

Audit Update: Submitting Your Annual Financial Report

It’s Audit Time! In Today’s Tip, we’ll be discussing the steps you need to take to submit/upload your Annual Audit — also referred to as the Annual Financial Report (AFR). At CSS, we help review and assist in the completion and submission of the audit for our Charter School Success clients. On-time audits are required to Pass FIRST, … Read More

Charter FIRST Hearing

Charter FIRST is the Financial Integrity Rating System of Texas (FIRST), which is detailed in Texas Education Code 39.082. The purpose and goal of having a financial accountability rating system is to ensure that open enrollment charter schools continually strive to improve the management of their financial resources and provide transparency and openly report results … Read More

Budget Timelines and Amendments

What is the role and purpose of the school budget? The charter school budget—and accompanying process—provides charters and their leaders with an opportunity to justify the collection and expenditure of public funds. In its most simple definition, a school budget describes a charter’s plan for the upcoming year as related to anticipated revenues and expenditures. … Read More

Updated State Aid Template available from TEA

The Charter School 2020-2021 State Aid Template is NOW AVAILABLE on the Texas Education Agency website! Over the last several months, Charter School Success has been working with our client charters to help develop their 2020-2021 budget, using the 2019-2020 State Aid Template information and calculations. Now that the 2020-2021 Estimate of State Aid Template … Read More