Contribution to TRS: New Minimum Salary Schedule increase

Although charter schools are not subject to paying their teachers based on the minimum salary schedule, HB3 requires that open enrollment charter schools pay the state’s contribution on the portion of a member’s TRS eligible salary that exceeds the statutory minimum or the “state minimum.” Members include classroom teachers, full-time librarians, full-time counselors certified under Subchapter B, Chapter 21, and full-time registered nurses. In addition, charter schools must also pay the state’s contribution for certain school personnel that were entitled to the minimum monthly salary under the following Texas Education Codes:

- Under former Texas Education Code (TEC) Section 16.056 as it existed on January 1, 1995

- Under Texas Education Code (TEC) Section 21.402

Register now for the new online course “TRS Statutory Minimum” for in-depth information.

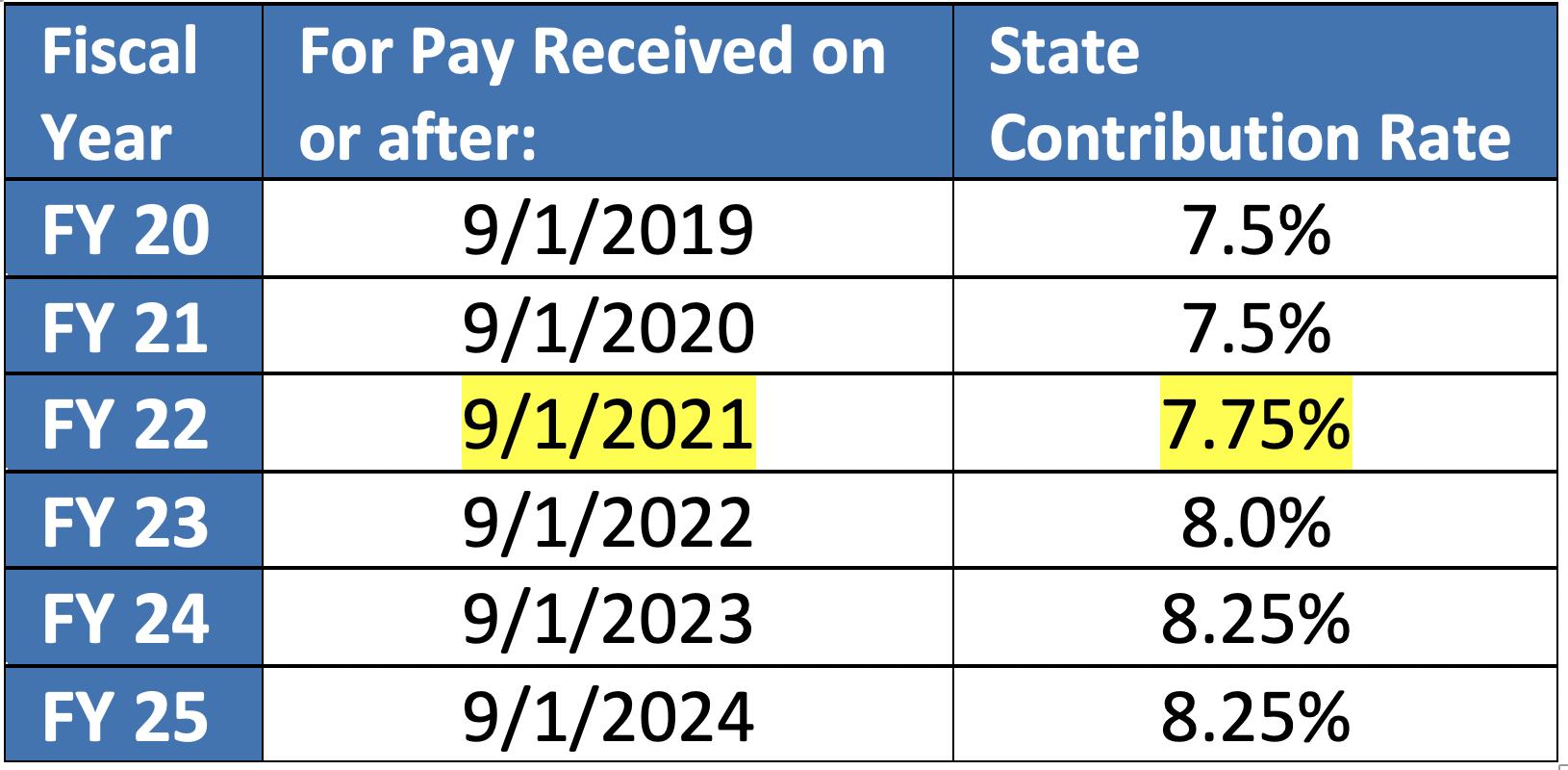

The state contribution rate is 7.75% for eligible compensation paid between 9/1/21 and 8/31/22. If a TRS eligible employee is paid from federal funds or a private grant, the charter school is required to pay the state’s contribution out of the same funding source/s.

The Teacher Retirement System of Texas (TRS) has published the following State Contribution Rate increases below:

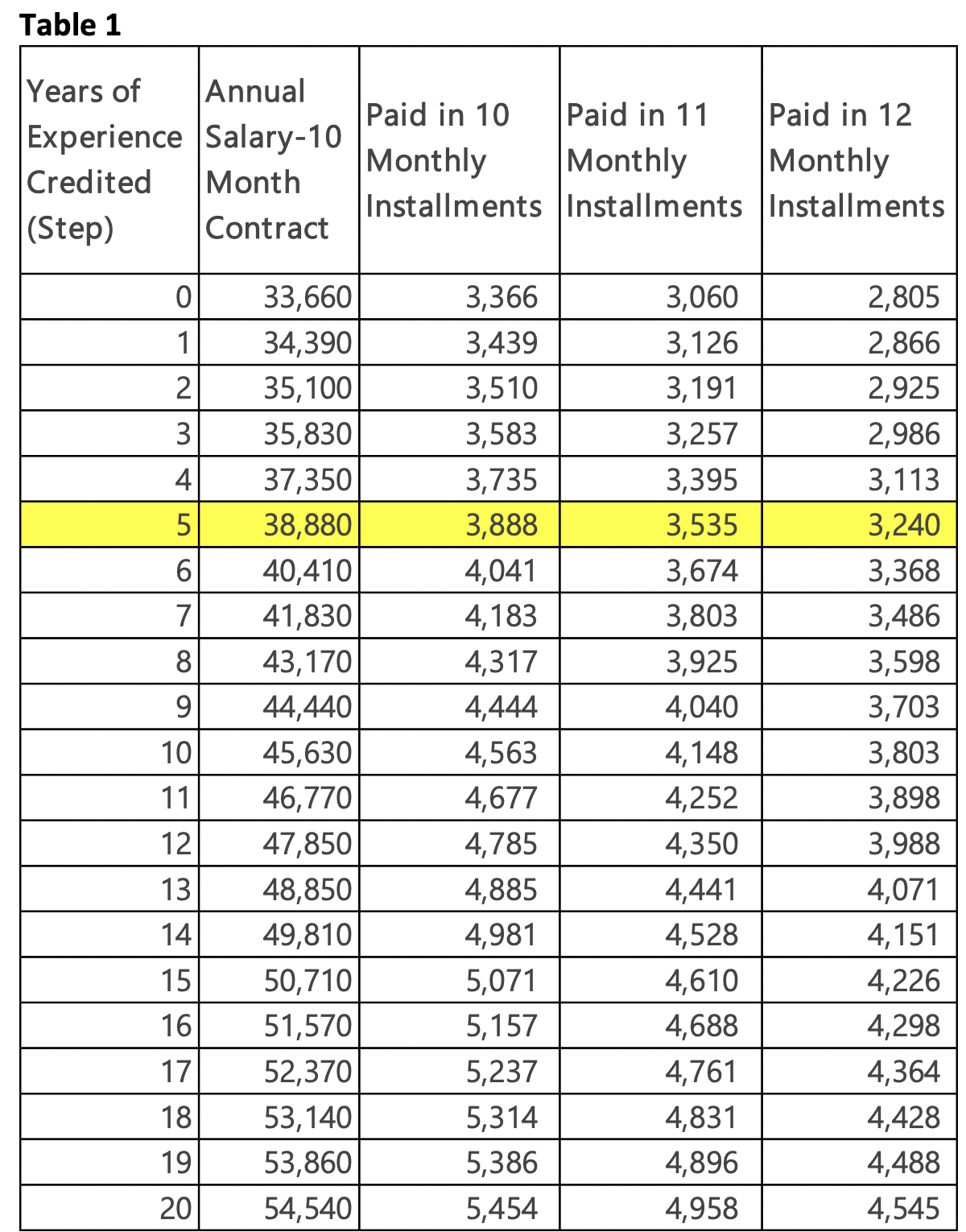

There are three tables (salary schedules) used to calculate the state’s contribution on the portion of a members TRS eligible salary that exceeds the statutory minimum:

- Teachers, Full-Time Librarians, Full-Time Counselors, and Full-Time Nurses

- For Members who would have been entitled to the Minimum Salary under former Section 16.056, Education Code on January 1, 1995

- Daily rate of pay salary schedule used to calculate the actual number of days in a person’s contract for those positions who would have been entitled to the Minimum Salary under former Section 16.056, Education Code on January 1, 1995

Click here to access the TRS State Minimum Salary Schedules: https://www.trs.texas.gov/Pages/re_state_minimum_salary.aspx

In order to calculate the statutory minimum contribution, the charter school must first know the number of years of professional experience for the employee.

In the example below, we’ll look at how to calculate the monthly state contribution amount for a 10-month Teacher on Step 5 that is paid over 12 months. The teacher’s annual salary is $50,500.

- Monthly State Minimum Salary – $38,880 / 12 = $3,240

- Monthly TRS Salary – $50,500 / 12 = $4,208.33

- Salary above State Minimum Salary – $4,208.33 – $3,240 = $968.33

- Monthly Reporting Entity Contribution – $968.33 X 7.75% = $75.05

*Statutory Minimum contribution is not due if the employee is paid an amount equal to or less than the Statutory Minimum Compensation.

*If an employee works another job that is unrelated to their primary position, compensation earned under this “wholly separate” position is not subject to the above state minimum contribution.

Click here to access additional resources related to charter schools that impact TRS reporting: https://www.youtube.com/watch?v=G_mul05Ht6w

Need some assistance?

Visit the Charter School Community Roundtable here.