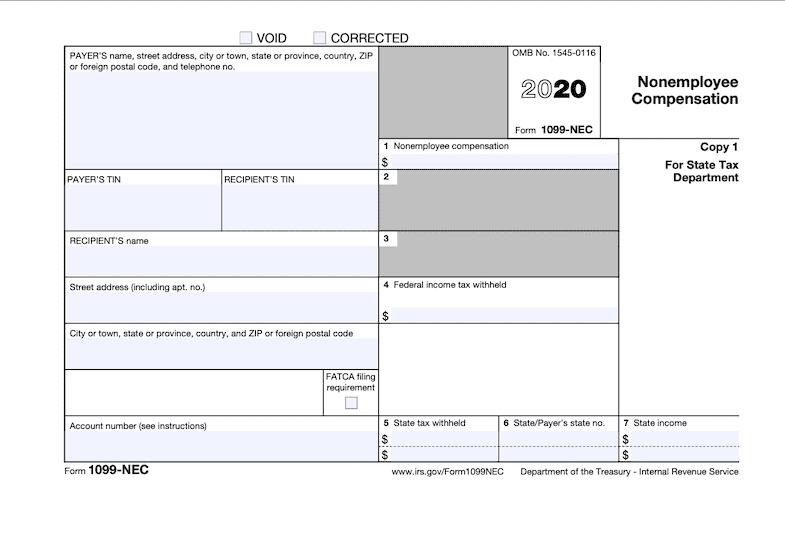

New 1099 Form to be used for 2020

Don’t let the new form make you uneasy. It’s filed just the same way that the old 1099-Misc non-employee compensation forms were filed. Your old box 7 vendors are now just getting their own special form, the 1099-NEC.

What’s new?

Effective for the 2020 tax year, form 1099-NEC has been implemented by the IRS. The Protecting Americans from Tax Hikes Act of 2015 (PATH Act), enacted on December 15, 2015, changed the way that we would file taxes. In order to cut down on fraud and errors, the PATH Act required that taxpayers who claimed the Earned Income Tax Credit (EITC) would have to wait until February 15th before they could receive their tax refunds. This would allow the IRS time to include 1099-MISC forms with their appropriate person being taxed.

The new 1099-NEC Form is meant to take the place of the 1099-MISC Box 7 forms. The required information is still the same, only the form has changed. 1099-MISC forms are still being used and relevant to the IRS, so be sure to use the proper form.

Who must file?

Any entity conducting a trade or business is required to file. Government agencies and non-profit organizations are also required to file. That means, Charter Schools mut file the appropriate 1099 form for their vendors as well.

What’s Reportable on 1099-NEC?

Payment to vendors for goods and services performs, such as: accounting services, attorney fees, contractor services, including payment for parts or materials used to perform the services if supplying the parts or materials was incidental to providing the service. Please read the IRS’s instruction manual on the 1099-NEC form for more information on who should receive a form.

https://www.irs.gov/instructions/i1099msc

Important Dates to be aware?

1099-NEC – New

- Copy A to IRS – February 1, 2021

- Copy B for Recipient – February 1, 20201

1099-MISC

- Copy B for Recipient – February 1, 2021

- Copy A to IRS (paper) – March 1, 2021

- Copy A to IRS (Electronically) – March 31, 2021

Normally, forms are due on January 31st of every year. This year, the 31st falls on a Sunday, so forms are due to the IRS on February 1st, 2021 this year.

Rules to Remember

- Always request a W9 and ensure it is properly filled out, signed, and dated before making a payment to a vendor.

- Never assume that a vendor does not need a 1099 because their company has the word “Co” or “Company in it.

- All payments to vendors over $600 within the calendar year need to be looked at.

- For every different type of 1099 form filed out, a 1096 is needed as a cover page to help differentiate the forms.

Additional Tips

- A 30-day extension of time to file may by submitted by using Form 8809.

- Make a plan to send out all W-2’s and 1099’s out before January 31st. This way, you can be sure to not miss a deadline.

- For more in-depth information on how to file your 1099-NEC and 1099-MISC form, please watch our webinar.

- Visit the Charter School Community Roundtable to ask questions, get answers and discuss this tip.