Let’s talk about charter amendments. Do you feel a little lost when those words come up, that they are too hard to understand or that another language is being spoken? It can seem that way, but really, once you know the in’s and out’s they aren’t as complicated as they may seem. In this tip … Read More

Random Validations – Title IV, Part A

This is the third in a series of program checkups. Click here for the first article on Title I, Part A, and click here for the second review on Title II, Part A. Collaboration and planning are key in ESSA program compliance, and Title IV is very similar to Title II regarding documenting your stakeholder … Read More

Mid-Year PEIMS Submission

Mid-Year PEIMS Submission The Mid-Year PEIMS submission is due to TEA January 28, 2021. This collection consists solely of financial data from your charter’s prior fiscal year, FY ending June 30 or August 31. Reviewed in comparison with the Annual Financial Report, (AFR), the data collected is used by TEA for compliance monitoring. In fact, … Read More

FFCRA Expired

Employers are no longer required to provide FFCRA leave after December 31, 2020, as the U.S. Department of Labor (DOL) announced. What did FFCRA include? The obligation was to provide FFCRA leave with an effective date of April 1, 2020, through December 31, 2020. Which included two paid leave offerings: The Emergency Paid Sick Leave … Read More

COVID-19 Vaccine Protocols

As we have seen, the COVID-19 vaccine is here and is being distributed across the country. As the vaccine becomes available to us the question arises: Can and will charter school employers require employees to get vaccinated? This is a consideration each school must carefully weigh. While employers can require the vaccine, before deciding to … Read More

Cares Act – Prior Purchase Reimbursement Program (PPRP) UPDATE

UPDATE: The PPRP program dates have been extended. Please see the updates on the Prior Purchase Reimbursement Program (PPRP) here on the CRF Reimbursement programs webpage. The PPRP application will reopen this month, with any new applications or amendments due by 1/31/21. The new deadline for receiving devices is 2/28/21. This may mean that your … Read More

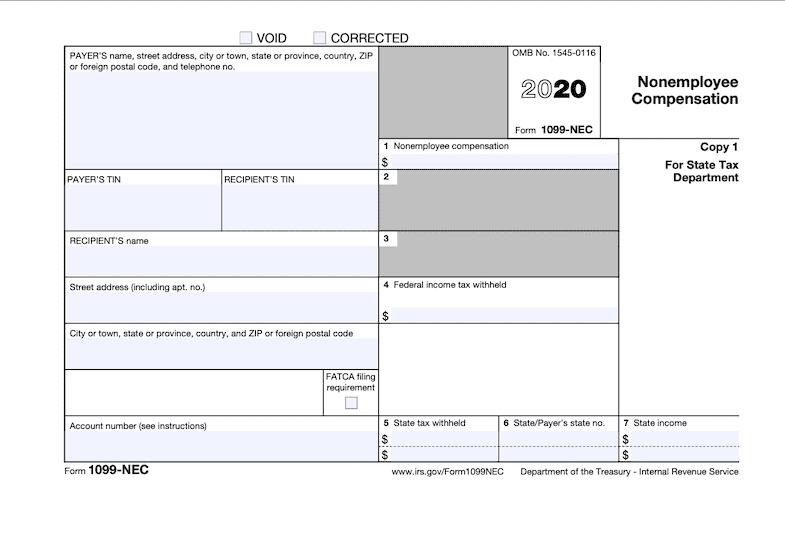

New 1099 Form to be used for 2020

Don’t let the new form make you uneasy. It’s filed just the same way that the old 1099-Misc non-employee compensation forms were filed. Your old box 7 vendors are now just getting their own special form, the 1099-NEC. What’s new? Effective for the 2020 tax year, form 1099-NEC has been implemented by the IRS. The … Read More